The art world has long been plagued by the specter of forgery, with counterfeit masterpieces slipping into galleries, auctions, and private collections for centuries. The shadowy trade in fake art—estimated to account for billions in annual losses—has thrived in an ecosystem of opacity, where provenance is often murky, and authentication relies heavily on fallible human expertise. But as blockchain-based provenance solutions gain traction, a radical shift is underway. Could this be the beginning of the end for art forgery?

The Scale of the Problem

Art forgery isn’t just a niche criminal enterprise; it’s a sophisticated global industry. From convincing Van Gogh knockoffs to fabricated "lost" Renaissance sculptures, counterfeiters have grown increasingly adept at exploiting gaps in the art market’s verification processes. Even renowned institutions have fallen victim—take the case of the Beltracchi scandal, where a German couple fooled experts with forgeries worth over $45 million. The lack of a standardized, tamper-proof record-keeping system has made the art world a playground for fraudsters.

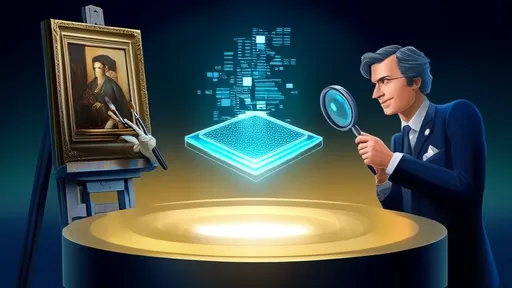

Traditional methods of authentication—brushstroke analysis, carbon dating, or expert appraisal—are slow, expensive, and often subjective. Worse still, paper certificates of authenticity can be forged or lost, while oral provenance (the word-of-mouth history of an artwork) is notoriously unreliable. This chaos creates fertile ground for fakes to circulate undetected, sometimes for decades.

How Blockchain Changes the Game

Blockchain’s promise lies in its ability to create an immutable, decentralized ledger. When applied to art provenance, each transaction—whether a sale, loan, or restoration—can be recorded as a permanent, timestamped entry. Unlike a paper trail, this digital record cannot be altered retroactively without leaving evidence of tampering. Artists, galleries, and collectors can now "anchor" a work’s history in a way that’s transparent yet secure.

Startups like Verisart and Codex Protocol are already partnering with museums and auction houses to embed cryptographic certificates into artworks. These digital IDs, often stored as NFTs or QR codes, contain details like creation date, materials, and ownership history. Scanning a tag instantly reveals whether a piece matches its blockchain record—a far cry from waiting weeks for a team of experts to weigh in.

The Human Factor

Technology alone won’t eradicate forgery. Blockchain’s effectiveness hinges on widespread adoption and rigorous initial verification. If a fake piece enters the system with fraudulent provenance (say, a bribed appraiser certifies a counterfeit), the blockchain merely perpetuates the lie. This underscores the need for multi-layered authentication: combining blockchain with AI-assisted image analysis, material forensics, and decentralized consensus among experts.

There’s also resistance from traditionalists. Some dealers thrive on the art market’s opacity, where undisclosed markups and ambiguous origins inflate profits. For them, blockchain’s transparency is a threat. Meanwhile, older collectors may distrust digital solutions, preferring the tactile certainty of paper documentation. Overcoming these cultural barriers is as critical as the tech itself.

Beyond Paintings: A Wider Impact

The implications extend beyond canvases. Sculptures, antiquities, even vintage wines—any asset where provenance dictates value—stand to benefit. Consider the 2018 case where a $4 million "Roman statue" was revealed to be a modern fake. Had its excavation and export records been logged on a blockchain, the forgery might have been spotted immediately.

Emerging applications are equally transformative. Artists can now program "smart contracts" into their digital works, ensuring royalties from resales—a feature physical art could adopt via blockchain-tracked ownership transfers. Museums, too, are using the tech to combat looted artifacts; the Louvre Abu Dhabi recently partnered with blockchain firm Emerge to verify acquisitions.

Challenges Ahead

For all its potential, blockchain provenance isn’t a silver bullet. High implementation costs and energy consumption (particularly for NFT-linked systems) remain hurdles. Smaller galleries and independent artists may struggle to adopt the tech without subsidies or simplified platforms. There’s also the risk of "garbage in, garbage out"—if initial data inputs are flawed, the system’s integrity collapses.

Legal frameworks lag behind, too. While France now requires digital certification for certain cultural exports, most countries lack regulations enforcing blockchain-based provenance. Until governments and industry bodies standardize practices, adoption will be patchy.

A New Era of Trust

Despite these obstacles, the trajectory is clear. As blockchain tools become more accessible and the art market faces growing pressure to clean up its act, forgers will find fewer cracks to exploit. The technology won’t eliminate fakes overnight, but it’s forcing a long-overdue reckoning with the art world’s culture of secrecy.

Perhaps the greatest shift is psychological. For centuries, art authentication has been a game of whispered reputations and elite gatekeeping. Blockchain democratizes that process, offering a shared, verifiable truth. In doing so, it doesn’t just protect buyers—it safeguards artistic legacy itself. The forger’s greatest weapon was always doubt; now, we’re building a system where trust is coded into the canvas.

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025

By /Jun 26, 2025